CBIRC Clarified Rules on Insurance Funds Investing Overseas through FMC Mandates

Eric (Ye) Zou

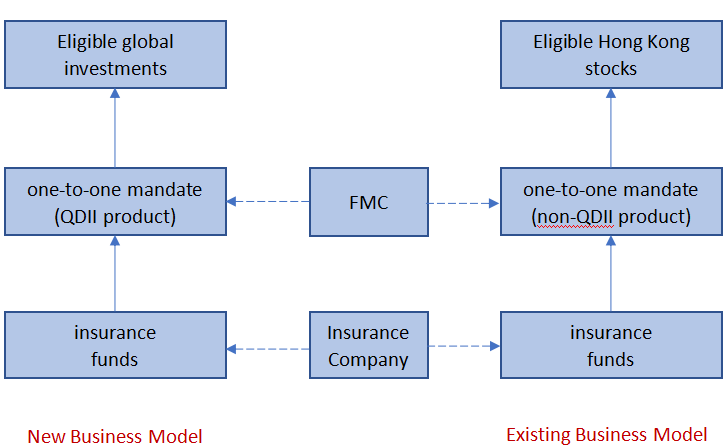

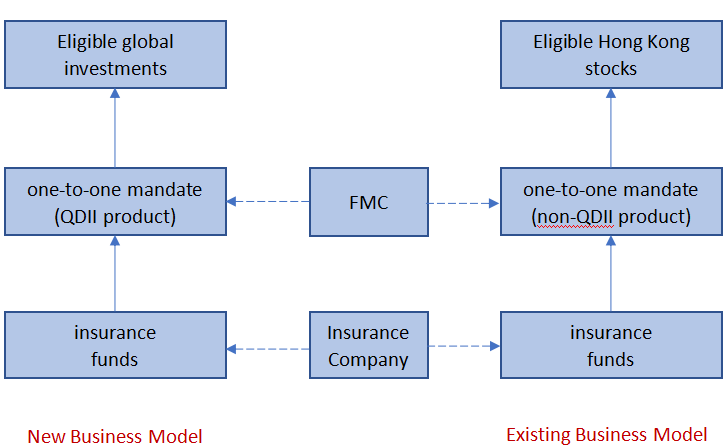

Recently, the China Banking and Insurance Regulatory Commission (“CBIRC”) clarified that one-to-one mandate (also known as single-investor asset management product) of public fund management companies (“FMC”) with investment by insurance funds are allowed to make overseas investment through QDII schemes of such FMC, in addition to investment through Stock Connect scheme.

With respect to the new business model, according to CBIRC, (i) insurance company, (ii) FMC and (ii) overseas investment by the mandate, are all required to follow regulatory rules on insurance QDII by CBIRC.

Therefore, under the new business model, please note that:

1. Regulatory rules by both CBIRC and the China Securities Regulatory Commission (“CSRC”) are applicable.

2. FMC need to comprehensively consider both (i) CBIRC regulatory rules on insurance QDII and (ii) CSRC regulatory rules on mandate QDII, which is not an easy job, requiring prudent analysis according to our experience.

Please contact us if you have any query.

Eric (Ye) Zou

Partner, Merits & Tree Law Offices

Contact:

Phone: (86 21) 5253 3523

Mobile: (86) 150 2176 3268

Email: eric.zou@yuanfo.net